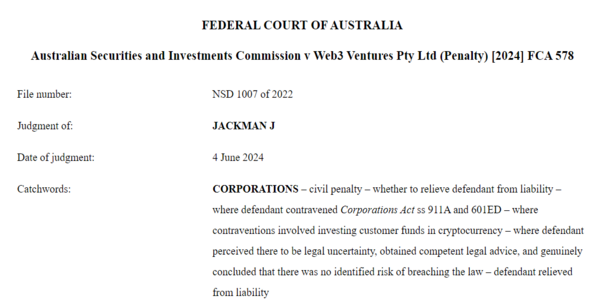

In a previous Lawsuit Battle between the Australian federal court and Block Earner, the Court found it guilty over unlicensed crypto yield-bearing products. The court decided a $40,000 fine, 3 times its illegal earnings, but unexpectedly, the Court stopped him from paying the penalty.

The Australian Federal Court softened its heart for the Fintech firm Block Earner after finding it guilty of illegally offering crypto-yield products and waiving its penalty.

Justice Ian Jackman provided remarks on June 4 that Block Earner acted honestly at the time of launching yield earning. It tried to get the license but its research and legal time advised that no license is required for it.

Charlie Karaboga, founder of Block Earner stated that it “showed that we acted honestly and did everything that we could do as a startup.”

He refused to refer to it as a “fair ruling,” saying instead that the sole “silver lining” was that there was no fine to be paid. Karaboga stated that the company has “lost a lot of money” in legal bills over the previous two years and continues to suffer “reputational damage” as a result of the case.

The Australian Securities and Investments Commission (ASIC) requested a 350,000 Australian dollars fine, but Judge Jackman rejected it. Block Earner requested an amount equal to three times its earnings from the product and sued for 60,000 Australian dollars.

In a June 4 Press release, ASIC stated that they are still reviewing the decision.

Justice Jackman ruled in February 2022 that Block Earner is offering yield on loans in different cryptocurrencies like BTC, and ETH, and now they need an Australian Financial Services License (AFSL).

The company’s “DeFi Access” product which offered yiead on loans did not fall in the penalty criteria as it is not operating under a managed investment scheme, so no AFSL was needed.

ASIC sued Block Earner on November 22, stating that it is running under a managed investment scheme and a pool where investor funds money, and spend to buy assets.

The Block Earner project operated between March 17, 2022, to Nov. 16, after that it ended due to court proceedings.