The short positions can be at risk if Bitcoin climbs back to its previous position, where it was changing hands 2 days before a slight dip.

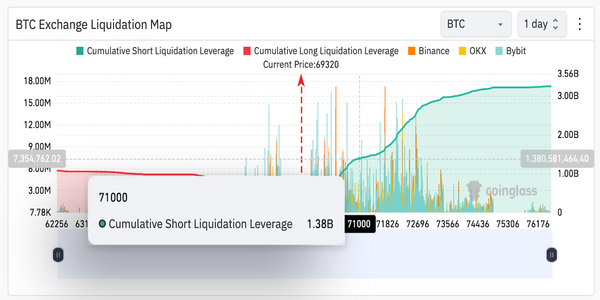

On June 6, bitcoin was trading around $71,000; after the market faced a dip, its price dropped to $69K. If the price of Bitcoin bounces back to the June 6 mark, it will result in the liquidation of more than $1 billion of short positions.

The major cause of the drop is the report of employment published by the United States, which crossed the expected mark in May, and the inflation rate rose by 0.1%.

According to CoinMarketCap data, Bitcoin faced a drop of 2.39% in its price and changed hands at $ 69.4K, Ethereum’s price dropped by 3.13% and is trading at $36.9K. at the same time, major altcoins also experienced a drop, like Pepe, which dropped its price by 9.16%, Matic, which dropped to 7.07%, and Cardano, which dropped to 5.57%.

The market drop caused a $409.51 million loss in both short and long positions, according to CoinGlass data. Out of this, $56.71 million were long positions in Bitcoin.

Source: CoinGlass

Between June 5 and June 6, the price of Bitcoin traded between $70,000 and $71,662. Many investors anticipate that it may conquer its all-time high soon.

Most traders are Opening Short Positions

The traders are not expecting Bitcoin to gain its previous price soon, leading to open short positions.

Now if Bitcoin regains its price of $71,000, $1.38 billion of short positions are at risk, but traders are expecting Bitcoin to make further deep corrections.

This follows investors wondering why Bitcoin’s price hasn’t exceeded its March all-time highs, despite 19 consecutive days of positive inflows into Bitcoin exchange-traded funds (ETFs).

“ETF flows are fantastic, but they are not strong enough to exceed the entire ecosystem selling yet,,” Charles Edwards, founder of Capriole Investments, stated while talking on a news platform

Crypto trader Christopher Inks emphasized that “the market is made up of spot, futures, ETFs, and options.”