Australia’s premier exchange considers the approval of spot Bitcoin ETFs, potentially paving the way for enhanced investment avenues within the cryptocurrency sector this year.

According to Jeff Yew, the CEO of Monochrome, Australia’s spot Bitcoin ETFs can bring $3 billion to $4 billion of cash inflow in the first three years. The Australian Securities Exchange (ASX), the largest exchange in Australia, will start accepting spot Bitcoin ETFs by the end of this year.

Some anonymous sources told Bloomberg that, keeping in mind the issue of funds faced by the United States and Hong Kong, VanEck Australia, and local ETF-focused fund manager BetaShares will get approval for their Bitcoin ETF applications this year.

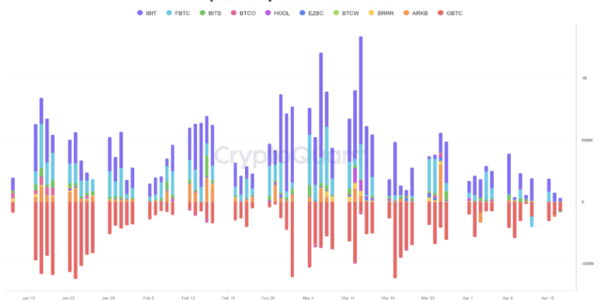

The spike in the price of Bitcoin ETF applications comes after its approval in the United States. This approval resulted in gathering $53 billion in assets under management (AUM) in eleven different products.

Source: CryptoQuant

The impressive flow of funds in the United States has given confidence to launch them in Australia and demonstrate that digital assets are here to stay,” said Justin Arzadon, the head of digital at BetaShares.

Spot Bitcoin ETF Potential: Australia’s Crypto Landscape

In a talk to Cointelegraph, Jeff Yew described Australia as a “very crypto-heavy country” and expects to generate $3–$4 billion in net inflow in the first three years.

Yew said that the Bitcoin spot ETFs would be mostly wanted by fund managers who want to invest in Bitcoin to get awareness of it and from self-managed super fund (SMSF) investors as well as smaller ones, with some interest from regular investors too.

Yew said that, at the time, investors owned Bitcoins through some exchanges, which is very risky. He says that it will be a great loss for them if the exchange fails or collapses.

“The Australian Taxation Office says there’s over $1 billion of crypto on exchanges and the majority of this is from SMSF investors,” he said.

Yew further stated that Bitcoin ETFs are safe exposure to digital assets

Monochrome initially requested approval for a spot Bitcoin ETF with the ASX on July 14, 2023. However, they later switched to Cboe Australia, a smaller exchange, due to a slow approval process.

“We switched to Cboe because it’s an exchange that offers a more realistic time frame and a more transparent listing framework.

“It’s no secret that the ASX had challenges lately with the regulator,” Yew said. “I think that’s just the appetite to push for new products is limited.”

Yew still has hope that Australia will approve spot Bitcoin ETFs “within the next few weeks.”