Bitcoin indicators show signs of stabilization and normalization, indicating a potential bullish trend, as analyzed by experts.

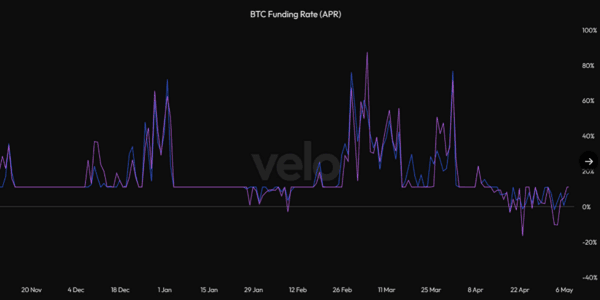

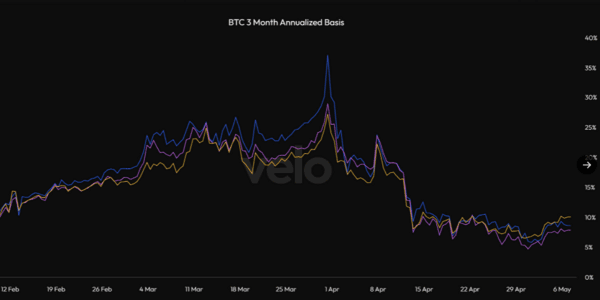

Traders are noticing stabilizing Bitcoin funding rate and 3-month annualized basis rates are coming to their normal position. These Two factors are in favor of Bitcoin, suggesting an upward trend in the market.

According to crypto analysts, two indicators, the Bitcoin funding rate and the 3-month annualized rate suggest that the price of the token is on its way to the bull run.

“Looks like we’re consolidating before the next leg up,” Will Clemente, co-founder of Reflexivity Research posted on X on May 7. In this post, he said that the two indicators cooled off, after a high instability in the market.

Source: Clemente

This chart showed negative sentiments on some days in April. The Funding rate is used to gather traders’ sentiments about the crypto market. Exchanges use this approach to check the traders opening long-position trades, compared to short-position trades. This keeps the balance and avoids overlapping trades.

When there are more traders opening long-term trades, it shows confidence in Bitcoin, resulting in a boost in its price.

The open interest funding rate, at the time of writing, is 0.0066%, up from 0.0050% on May 4, as per the data of Coinglass.

“Sounds like the calm before the storm,” according to the pseudonymous crypto commentator Crypto Empire.

“The Bitcoin funding rates still remaining this low, while Bitcoin is bouncing makes me feel extremely bullish,” Mister Crypto posted on X.

This shifting of negative sentiments to positive ones also impacted the Bitcoin price, showing a slight increase.

The liquidation data shows the opposite of this, indicating that future traders still predict the bearish trend in BTC price.

If Bitcoin reaches the price of $65,000, it can result in the liquidation of $1.36 billion of the short position; if it drops to $60,000, it can only bleed $650 million in the long position as per coinmarketcap data.

Source: Clemente

Some traders witnessed a 5%–10% increase in Bitcoin‘s annualized basis rates on major exchanges like Binance, OKX, and Deribit.

This process measures the cost difference between a Bitcoin futures contract and the actual price of Bitcoin.

Traders typically consider rates above 10% as a neutral-to-bullish signal.