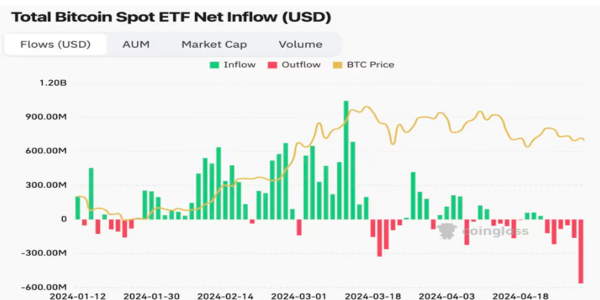

Wednesday becomes a dark day for US Bitcoin ETFs as holders sell their digital assets in bulk. The chairman of the Federal Reserve, Jerome Powell, dismissed the possibility of a spike in rates.

Source: Coinglass

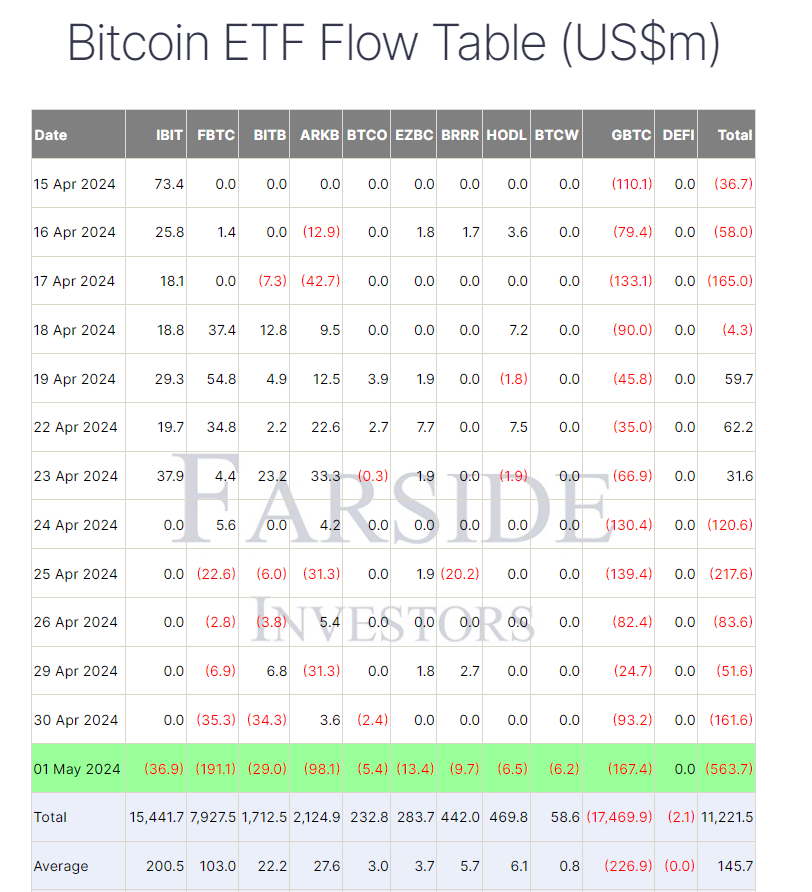

Sales calculated on this day by 11 US-based ETFs are $563.7 million. This is the largest since the EFTs started trading in January. This extends to a five-day sale trend, according to the data gathered from Farside Investors and CoinGlass. Total withdrawals made by investors from US-based EFTs have totaled $1.2 billion since April 24.

On Wednesday, Fidelity’s FBTC encountered a massive outflow, resulting in losing $191.1 million in withdrawals. This situation can possibly be an indication for a bull market, as FBTC and BlackRock’s IBIT gathered more funds in the first quarter than the outflog.

Source: Farside investors

Bitcoin ETF Launch Impact: Fed’s Stance and Liquidity Measures

On this day, another large outflow of $167.4 million was witnessed by GBTC. This is the outcome of the withdrawal of ARKB’s $98.1 million and IBIT’s $36.9 million. Powell, who is a supporter of risky assets like Bitcoin, says this dovish approach also leads to bleeding in other assets. A “dovish” approach means the central bank prioritizes employment and economic growth over tightening the money supply excessively.

While setting the benchmark interest rate on Wednesday, the Fed kept it unchanged between 5,25% and 5.5%, as expected. In a press conference, he stated that the economy is robust, pointing out that there won’t be any changes. He also raised his concerns about potential rate increase or liquidity tightening due to recent disappointing inflation data.

The Fed announced the reduction of its alternate liquidity tightening program, known as quantitative tightening (QT), starting June. Additionally, the U.S. Treasury introduced a program to repurchase billions of dollars in government debts for the first time in over two decades to enhance liquidity in the bond market.

Bitcoin, along with other risky assets, reacts to expected changes in liquidity conditions. Following Powell’s comments, the price of Bitcoin spiked to $59,430 from $56,620. The yields on the 10- and two-year Treasury bills dropped, as did the dollar index.

Bitcoin spike resulted for a short time, falling back to $57,747 at the time of writing. This week, the launch of Asia’s first Bitcoin ETFs in Hong Kong, encountered a low trading volume, which had a negative impact on the crypto market.