Crypto culture has grown more tribal in recent years, with fans of different tokens often clashing on social media. One common insult in these debates is to claim that another cryptocurrency is centralized.

Many crypto investors mistakenly believe that all blockchains are decentralized by nature. But what does decentralization mean, and how can investors tell if a coin is truly decentralized or not?

Understanding the concept of Decentralization

A good or service is considered decentralized in a way that one participant does not govern the system, but rather it is controlled by a group in accordance to the votes of the majority. For instance in the case of Bitcoin, various essential features such as the total number of bitcoins that are to be issued are controlled by a majority of the nodes in the network.

Understanding decentralization is, therefore, a fundamental prerequisite in comprehending cryptocurrency in general as well as its existence in the first place.

Centralized systems where a single entity has end-to-end control expose multiple issues such as conflicts of interest and have inherent issues of centralization failure since it’s easily attacked.

On the one hand, in the decentralized system, there is no single point of failure, and modification must garner consensus from the majority of participants that limits the potential attempts to attack or corrupt the system.

Besides the partially centralized Internet, Bitcoin is one of the first exact examples of a system devoid of a control center.

Decentralization in Blockchain

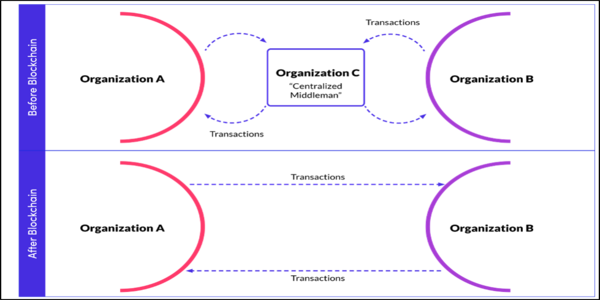

In simple terms, decentralization is the act of breaking or disseminating information/ transactions among many peers unlike having a central controller.

The concept of “Resource” can be something on the blockchain not only confined to value exchange; it also extends to data of products, agreements, partnerships, and ownership. Other peer-to-peer networks result in the creation of a copy of the value being transferred but the credit does not pass from one individual to the other, though this may seem to be the case with the use of a blockchain.

Decentralization in Business

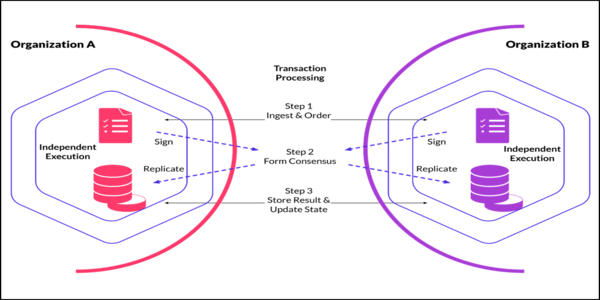

By decentralizing a business, there is no centralized control, and all persons who are involved in the business deal with each other through the smart contract. Contrary to the case where one organization owns all the assets and controls all information within it, all databases are centralized and both organizations have access to them.

Physical Decentralization

Physical decentralization involves distributing storage space for blocks all over the world and with sufficient backup. The goal is to introduce as many affiliations as possible in the network, or as a proven technology distribution on a worldwide basis that nobody can monopolize.

Transactional Decentralization

Such a type of blockchain decentralization enhances the B2B network of business by making it more transparent, efficient, and secure.

B2B blockchains are necessary in many companies because they offer access to the value chain and sophisticated business relations. This location can depend on the purpose of decentralization which can include: Avoiding point failures, to locating the nodes closer to the users, many people may want nodes in their geographical area because it’s economic incentives, or because regulation supports it.

Architectural Decentralization

Such a type of blockchain decentralization is based on the number of systems that balance the given network. As the number of nodes or systems increases, this means that the blockchain is less and less centralized. Overall, damaged systems can be replaced which means that the network does not stop working even if some of the systems are out.

Political Decentralization

Political decentralization is concentrated on the extent of identities or entities in the management of systems within the network. For example, a blockchain can involve many servers at once but, if only one particular organization, or a person, controls the blockchain, there is no political decentralization.

The anatomy of politically decentralized networks is reflected in Bitcoin and some other leading layer 1 blockchain.

Logical Decentralization

This form of decentralization talks about how a blockchain is depicted with its interfaces as well as data structures. For instance, Bitcoin cannot be regarded as logically decentralized since it has a unified system operating as a single network.

It goes without saying that if a blockchain is architecturally decentralized if it is dispersed across many computers, and it is politically decentralized as well – it is not governed by a single authority – it can still form one unified network.

Bitcoin is not logically decentralized because it is a unified single network. Applying the same concept, if there were more than one network in the world with different systems and procedures but share the same system of value as that of Bitcoin it could be more of a logically decentralized system.

Decentralization in Finance

DeFi is an emerging financial system that poses a threat to the current financial systems common in most countries of the world. DeFi aims at eliminating the fees that banks and other financial institutions use when providing their services, opting for direct user-to-user transactions.

What started as decentralized finance or DeFi, and the blockchains and cryptocurrencies behind it, is still nascent and there is a long way to go before it can completely supplant what is already in place.

Though the traditional system has its problems, it is not very easy to bring changes and solve the problems. Also, banks and financial firms will not surrender their post – they will look for ways to make money in the blockchain finance transition and stay engaged.