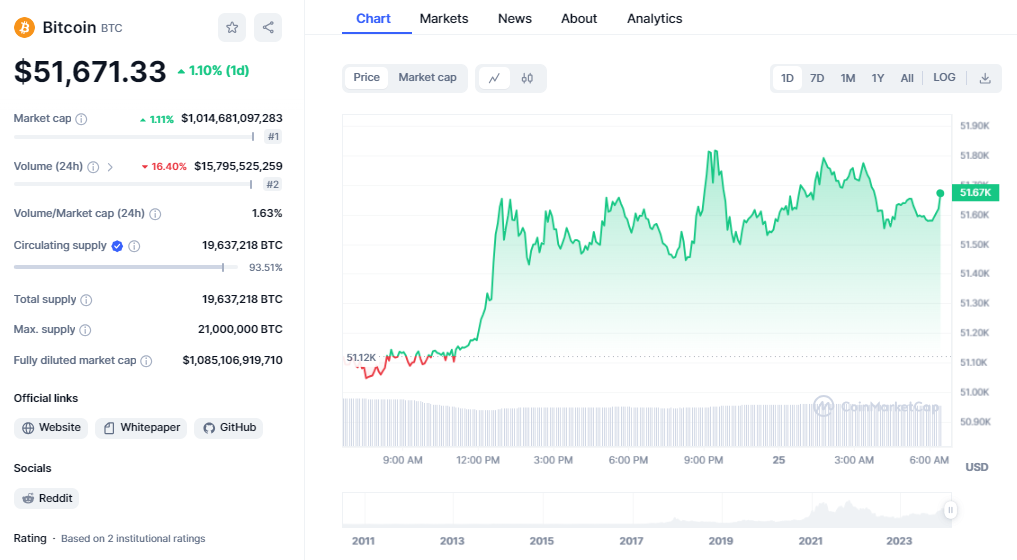

On Sunday, February 25, 2024, Bitcoin did well, rising 1.15% to trade at $51,671. At the same time, the Texas Blockchain Council and Riot Platforms had a big legal win. They won against US energy regulators. This victory secured a temporary order. It highlighted the ongoing debate about rules for cryptocurrency mining.

Meanwhile, in Nigeria, there’s a call for clearer rules. The goal is to ease worries and help the cryptocurrency industry grow. This highlights how complicated it is to manage cryptocurrencies globally.

With these changes, people are closely watching BTC’s price. It seems cautiously positive for now, depending on certain support levels.

Legal wins, regulatory challenges, and market movements show clearly how the cryptocurrency world is changing.

Texas Blockchain Council, Riot Platforms Win Legal Battle Against US Regulators

In a major legal battle, the Texas Blockchain Council (TBC) and Riot Platforms got a temporary restraining order (TRO) from a US District Judge. It is against multiple US energy regulators. The order aims to stop certain actions. These actions are seen as overreaching in data collection from cryptocurrency mining.

This move responds to what the plaintiffs describe as overreaching. The Energy Information Administration and the U.S. Department of Energy want data from cryptocurrency miners. This could cause irreversible harm. It would bring costs, legal threats, and the forced disclosure of business secrets.

Key Highlights

The TBC and Riot Platforms secured a TRO against US energy authorities. The TRO concerns data collection for cryptocurrency mining. The court recognized potential harm. This harm comes from costs to comply, legal threats, and exposing business secrets.

The ruling suggests energy regulators may have overreached. And judges are more aware of how cryptocurrency rules affect regulation. This decision eases concerns in the Top crypto market. It also promotes a more positive outlook among investors.

It may encourage more balanced discussions and policies. This is considering regulatory objectives and growth in the digital currency space.

Carlson Group Enhances Investment Portfolio with Addition of Four BTC ETFs

The Carlson Group manages $30 billion in assets. It added four BTC ETFs from BlackRock, Fidelity, Bitwise, and Franklin Templeton. These ETFs cater to registered investment advisers (RIAs).

ETFs were chosen for their asset growth, trading, and low fees. BlackRock’s IBIT and Fidelity’s FBTC were noted for their big inflows. Bitwise Bitcoin ETF (BITB) and Franklin Bitcoin ETF (EZBC) were added. This was due to their commitment to low-cost services.

Vice President Grant Engelbart highlighted Carlson Group’s interest in cryptocurrency investments, which could affect BTC prices because it offers authorized investment options to institutional investors.

The impact on the market right away might depend on how quickly trading platforms start using these options.

Bitcoin Price Prediction

As of February 25, BTC’s price is relatively stable, ranging between $51,000 and $52,500. It’s slightly above its pivot level at $52,515, showing some optimism in the market.

The Resistant level is set at $52,500, while the support level is at $50,900. The Relative Strength Index (RSI) is at 55, suggesting a balanced market without being too overbought or oversold.

The 60-day and 30-day Exponential Moving Average (EMA) are at $51,409 and $51,638, respectively, indicating a positive trend if BTC stays above $51,000.

In summary, Bitcoin’s short-term outlook looks cautiously optimistic, depending on its ability to stay above $51,200.