There are reasons for Bitcoin’s imminent new highs, as support is firming up, open interest is soaring, and ETFs are making waves.

With Bitcoin still trending slightly below its all-time high, the surge in BTC futures open interest is above $37. $5 billion raises the prospect of a significant rally driven by the fear of missing out if it rises above $72,000.

The bitcoin price rising to $72,000 pushed the altcoins higher as BNB/USD rose to $716 by breaking key resistance levels.

The biggest crypto was valued at $71,447 with a 1. It rose by 2% in 24 hours, following a 5% uplift in a week based on the rates on CoinGecko and a 12% hike in a month.

Deciphering Bitcoin’s Future: Prospects of BTC in the Near Future

There is no stopping the bitcoin bulls as they aim towards a new record high of $73,837, with the daily chart continuing to have the green light and heading way above the $72,000 weekly resistance.

And as bulls break above this level, there is optimism for a move past the previous record high and opening the door to FOMO, with a target of $80,000 per BTC and a possible target of $100,000 by year-end.

The MACD indicator suggests buying signals, such as the blue MACD line crossing the orange signal line in mid-May.

The 20-day, 50-day, and 100-day Exponential Moving Averages (EMA) all support the bullish view of the market.

This suggests that Bitcoin has a tendency to reach new highs or a record high, confirming that the least resistance path is upwards.

The Money Flow Index (MFI) rising from 50 to 68 indicates that the bulls are getting more confident, hinting that Bitcoin might retest its all-time high at $72k for a new high if the upward momentum continues.

Record-Breaking: Bitcoin Futures Open Interest Reaches New All-Time High

Coinglass reports historic highs as total Bitcoin open interest (OI) surges to $37.5 billion, marking a significant milestone following Bitcoin’s rebound above $70,000 from a May correction to $56,500.

Rising Bitcoin futures open interest serves as a bullish indicator, reflecting investor optimism and heightening the likelihood of a breakout to new all-time highs.

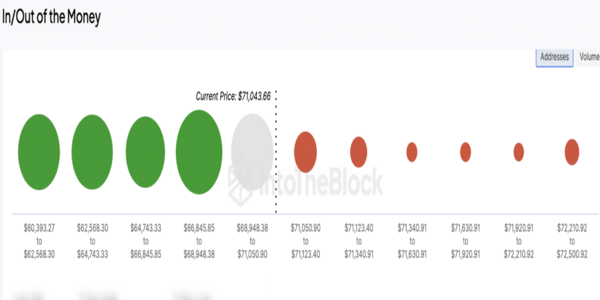

Understanding Bitcoin’s robust support areas, highlighted by the IOMAP model, is crucial for informed trading decisions and predicting potential bounce zones during pullbacks.

The absence of significant resistance zones signals bullish dominance, suggesting that even a slight upward push in Bitcoin’s price could catalyze a substantial rally.