On May 21, Bitcoin hit the mark of $71,000 and slightly moved back to $70,974. After a six-week all-time high, Bitcoin price prediction is seeking attention from all investors. This propel is an outcome of the massive inflow of funds in spot BTC ETFs. Other big industrial investors, like Morgan Stanley and JPMorgan also played a major role in it.

The overall crypto market showed bullish sentiment after the approval of Ethereum ETFs by the SEC. As Bitcoin is nearing its previous peak, many analysts and investors are sharing their thoughts about the next step of BTC.

Crypto Investments Surge as Bitcoin Inflows Hit New Highs

Consumer Price Index (CPI) showed an unexpected rise in investments in digital assets. The total inflow of funds reached $932 million in the last two weeks, as per the CPI.

Bitcoin successfully gained the confidence of the investors, as a total of 89% of the digital inflow came in the last three days. Bitcoin’s total inflow of $942 million is an indication of more investors participating in the BTC pool.

Besides Bitcoin, other altcoins like Solana, Cadano, and Matic also managed to attract investors. After the approval of Ethereum ETFs, ETH also added $23 million of funds to its pool. The U.S. topped the chart with $1.002 billion in inflows, driven by positive developments at Grayscale. However, Hong Kong, Canada, and Blockchain-related stocks experience an outflow.

The positive response by the Crypto market, especially Bitcoin, highlighted the positive sentiments that will grow strong shortly.

Approval of Ethereum ETFs Boosted Market and BTC Price

Ethereum’s price surged by more than 16% after Bloomberg analysts increased the chances of a spot Ethereum ETF approval to 75%, pointing to possible political pressure on the SEC.

Nate Geraci explained how the SEC approves ETFs. He suggested that if they approve certain filings, it could lead to more approvals later on. Even though there were concerns when the CEO left, the better chances of ETF approval now are good news for Ethereum.

Bitcoin Price Prediction

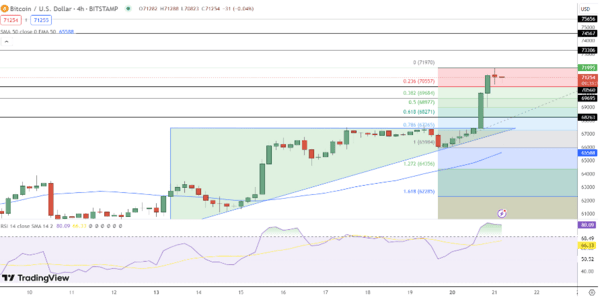

At the time of writing, Bitcoin is trading around $71,229, showing a rise of 6.17% as per coinmarketcap. Even after this high price, the Bitcoin market still shows a Bullish sentiment. The 4-hour chart shows some key point indicators on the monitor.

The pinpoint for BTC is set at $71,995, with the upcoming resistance at $73,306, followed by the upcoming resistance at $74,567 and $75,656. If the Bitcoin drops, the immediate support level is at $70,560, however, in case of major drops, the lower supports are set at $69,695 and $68,263.

The technical indicators suggest remaining careful, as the Relative Strength Index showed an overbought condition and suggests holding back as the RSI stands at 80. The Exponential Moving Average (EMA) of 50 days is at a digit of $65,588, indicating an upward trend and ignoring the volatile market.

Bitcoin is showing a significant closeness to the Doji candle, followed by solid bullish engulfing candles. These indications typically direct towards a deep correction. In such a case, BTC can drop almost 38.2% to the Fibonacci retracement level around $69,500.

However, while talking about a Bullish Market, if the price of BTC breaks above $72,000, it can go to the mark of $73,275 or even $74,500.