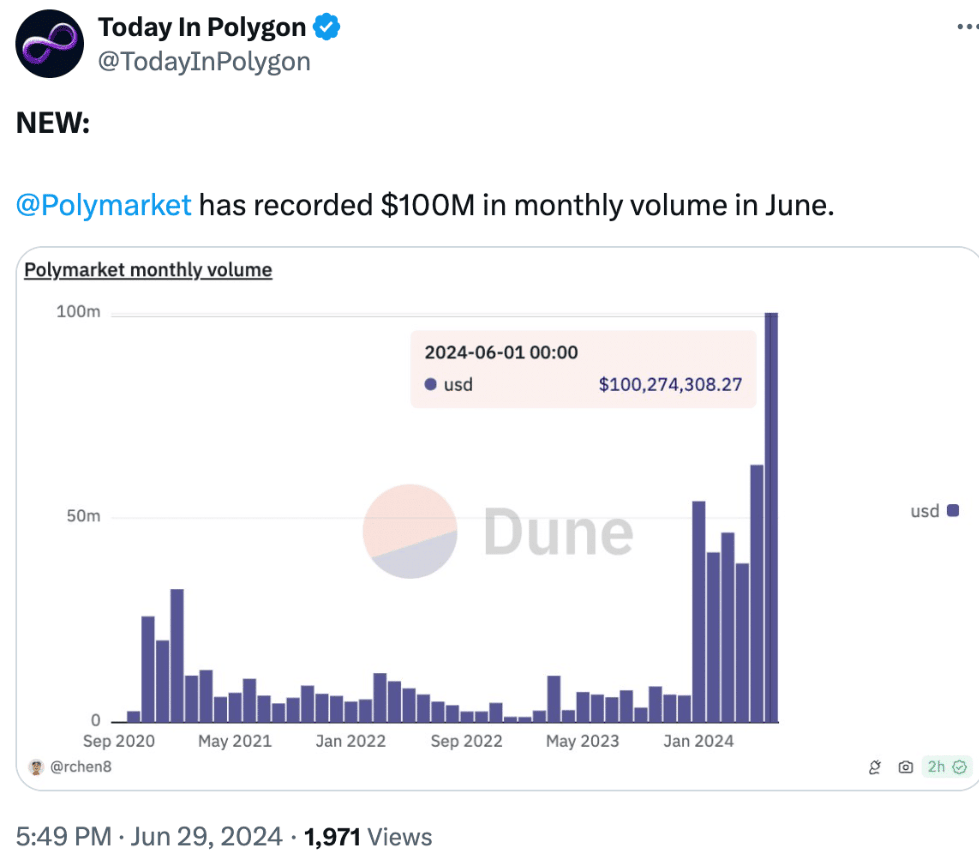

Polymarket on experiences massive growth, where trading polygon volume exceed $100 million, indicating high market demand for decentralized predictions.

However, the volume and activity of Polymarket on Polygon crossing $100 million, the price of MATIC and its network witnessed downtrends.

Polygon (MATIC) enjoys high network activity within the ecosystem originating from the use and demand of its various dApps

Polymarkets: New Opportunities in the Polygon Ecosystem

The events-based betting dApp known as Polymarket has crossed the $100 million trading volume, indicating a boost in traffic.

The use of dApps like Polymarket ensures that more users are encouraged to join the Polygon network.

Polymarket’s success story is inspiring more developers to build various forms of dApps on Polygon and diversify the ecosystem.

More usage and users are expected to improve the MATIC price with the rising need for gas fees and other vital capabilities within the Polygon network.

Checking In on MATIC: Price Trends and Ecosystem Growth

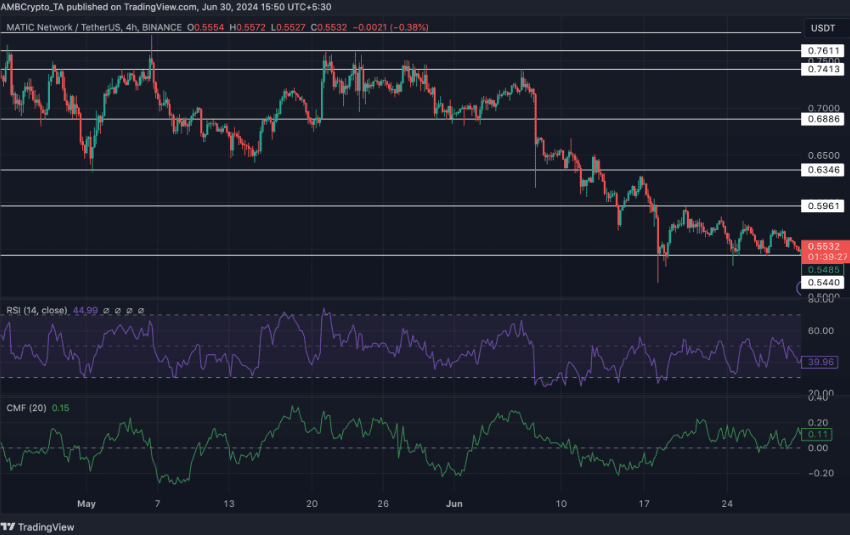

At $0.5524, the price of MATIC dropped by 1.08% in the last 24 hours and has been trending down since June 7th.

Thus, during this period, several lower lows and lower highs were depicted for MATIC, indicating bearish price action.

The receding trend of the Relative Strength Index (RSI) for MATIC in this period shows a diminishing bullish sentiment for the token.

Further, the volume of MATIC/USD pair has shrunk by 30% in the last month due to reduced trading activity.

Although most of the other metrics have pulled down, a relatively high rise in the CMF of MATIC indicates a recent increase in money flowing into the token.

If sustained, increased money flow could support the prospects of a reversal: A break above $0.5961 may open up the possibility of targeting $0.7413 for MATIC.

Disclaimer: Cryptocurrency investments are considered high-risk and may result in an entire lack of capital; the facts provided are widespread, and beginners are not advised to spend money on shares.